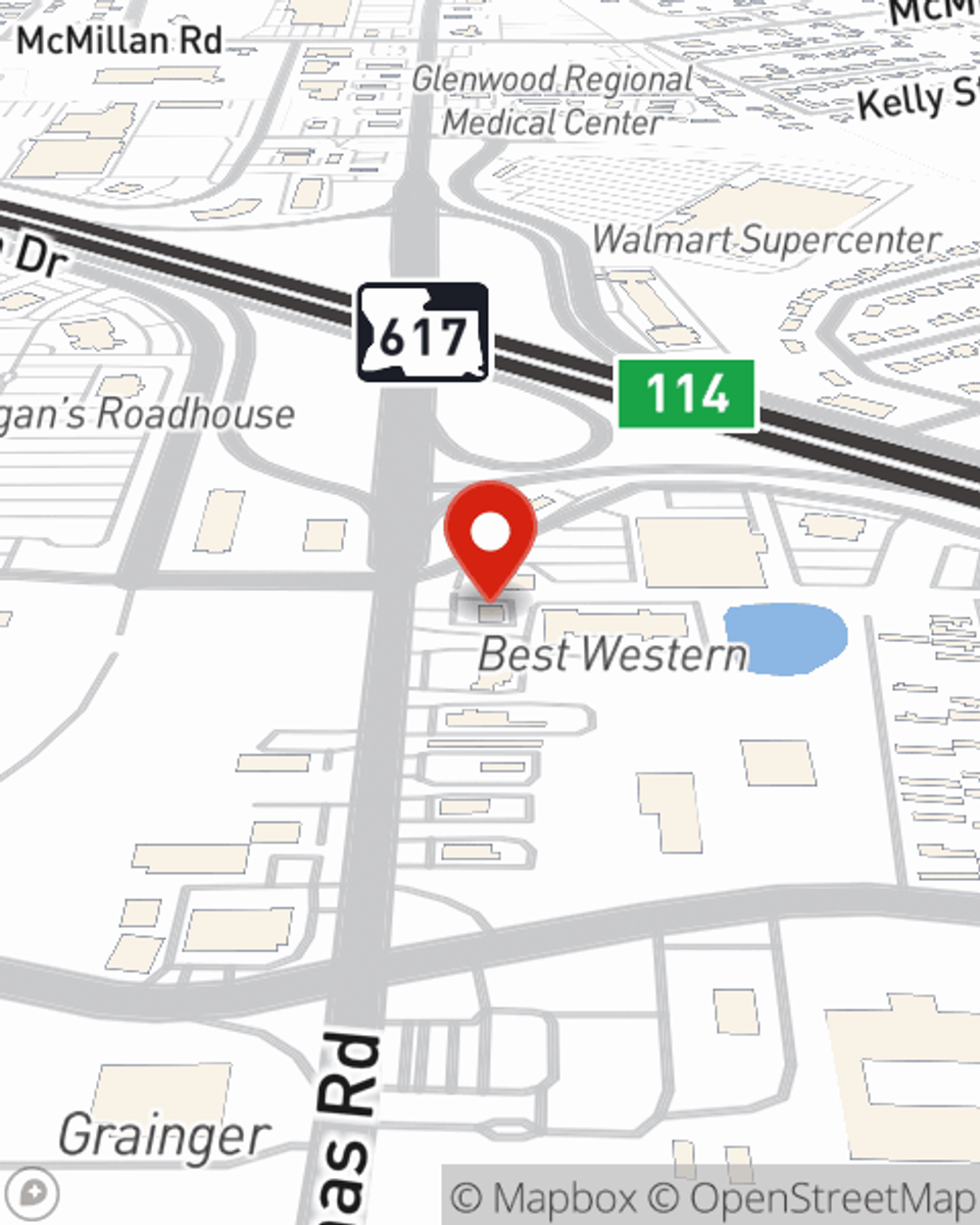

Homeowners Insurance in and around West Monroe

Homeowners of West Monroe, State Farm has you covered

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

With State Farm's Insurance, You Are Home

Home is where your heart is. You need homeowners coverage to keep it safe! You’ll get that with homeowners insurance from State Farm, an industry leader in homeowners insurance. State Farm Agent Jordan Wiggins is your reliable authority who can offer coverage options aligned with your particular needs.

Homeowners of West Monroe, State Farm has you covered

The key to great homeowners insurance.

Safeguard Your Greatest Asset

Jordan Wiggins will help you feel right at home by getting you set up with reliable insurance that fits your needs. State Farm's coverage for your home not only covers the structure of your home, but can also protect precious items like your pictures.

Don’t let worries about your home make you unsettled! Contact State Farm Agent Jordan Wiggins today and discover how you can meet your needs with State Farm homeowners insurance.

Have More Questions About Homeowners Insurance?

Call Jordan at (318) 323-6262 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Home lightning protection

Home lightning protection

Home lightning protection can help reduce the risk of lightning damage and help protect your home.

Closing documents to keep after purchasing a house

Closing documents to keep after purchasing a house

A guide to the closing documents to keep after you buy your house — and what you can consider getting rid of.

Jordan Wiggins

State Farm® Insurance AgentSimple Insights®

Home lightning protection

Home lightning protection

Home lightning protection can help reduce the risk of lightning damage and help protect your home.

Closing documents to keep after purchasing a house

Closing documents to keep after purchasing a house

A guide to the closing documents to keep after you buy your house — and what you can consider getting rid of.